Virtual Bank Account Abroad: A Complete Guide for Global Users

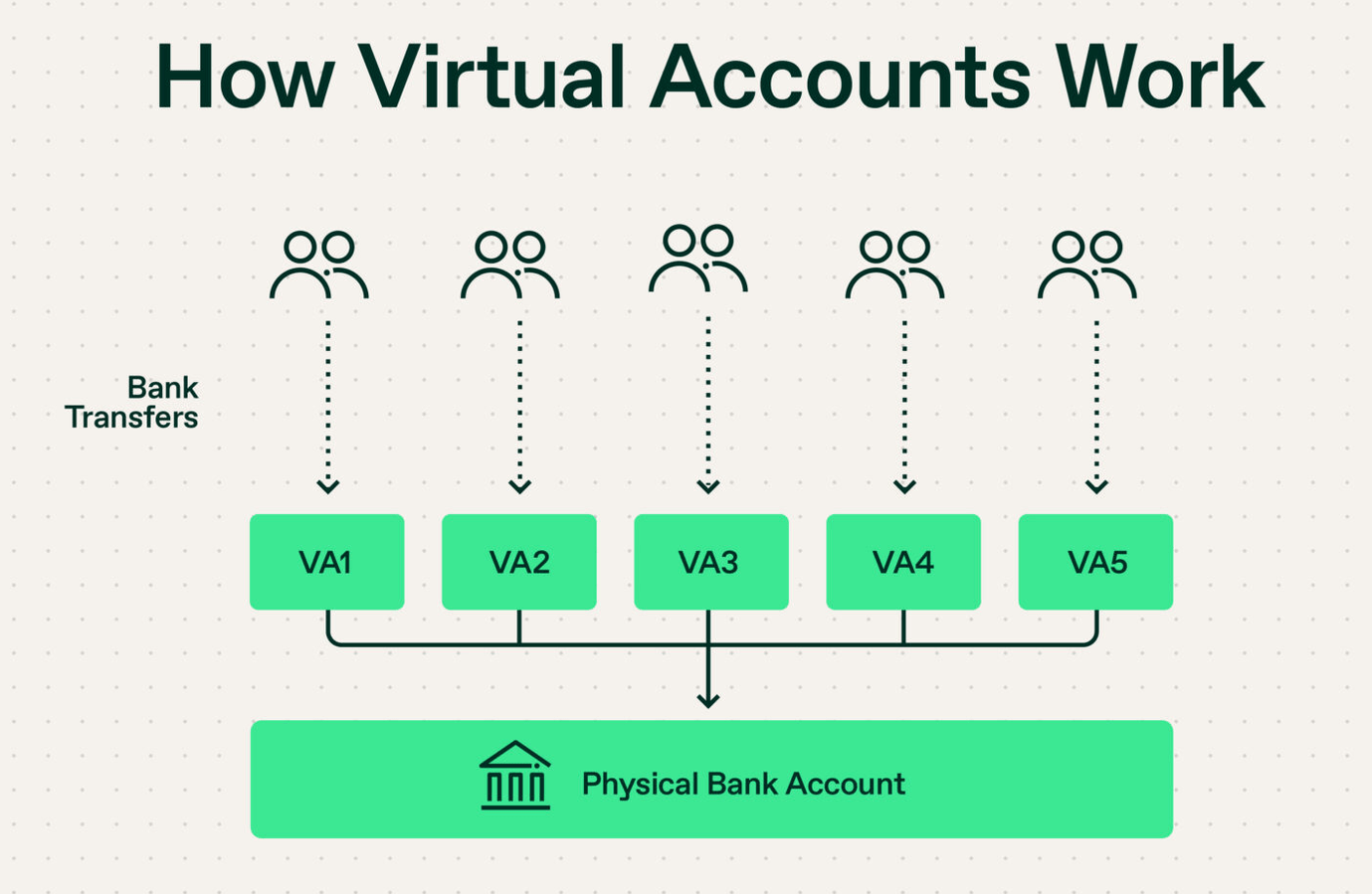

A virtual bank account is a digital-only bank account that allows individuals or businesses to manage their finances online without the need for a physical branch visit. These accounts are commonly offered by neobanks or fintech companies, and are often linked to traditional banks for core banking infrastructure. Users can send, receive, and store money, make international transfers, and often enjoy multi-currency support.

The main appeal of a virtual bank account, especially when opened abroad, lies in the ability to access foreign financial systems without having to be physically present. For freelancers, digital nomads, small business owners, and expats, this provides a convenient way to earn, save, and spend money across borders.

Why Virtual Bank Accounts Matter Today

The demand for virtual bank accounts abroad is growing rapidly due to several global trends:

-

Remote Work Culture: As more professionals work from anywhere in the world, they need easy ways to get paid and manage money internationally.

-

Global E-commerce: Online sellers require banking options that support multiple currencies and international transactions.

-

Cross-Border Freelancing: Freelancers often work for clients in other countries and want to avoid high fees and long waits for payments.

-

Digital Transformation: Traditional banking is becoming less relevant for users who prefer mobile apps and instant access.

Without a foreign bank account, individuals face issues like:

-

High international transaction fees

-

Currency conversion losses

-

Delayed payments

-

Limited access to financial tools or credit in foreign countries

Virtual bank accounts solve these problems by offering faster, cheaper, and more flexible banking options, often with lower entry barriers than traditional banks.

Recent Trends and Developments (2024–2025)

The global fintech industry saw significant changes between 2024 and 2025, especially around regulatory flexibility and digital finance tools.

| Development | Details |

|---|---|

| EU Digital Finance Package Update (2024) | Streamlined cross-border fintech licensing, making it easier for providers to offer virtual banking services across the European Union. |

| India's RBI Fintech Sandbox Expansion (May 2024) | Opened opportunities for Indian fintechs to test cross-border digital banking tools under regulatory guidance. |

| US FinCEN Guidance (2025) | Updated regulations requiring enhanced KYC for foreign account holders in virtual banks operating from the US. |

| Rise of Multi-Currency IBANs | Services like Wise and Payoneer expanded their multi-currency IBAN services in 2025, making it easier for users to receive payments globally. |

Legal and Regulatory Landscape

The legal framework for virtual bank accounts varies by country and region. Here’s an overview of key regulations affecting global users:

1. Europe

-

PSD2 (Payment Services Directive 2) allows fintechs to offer digital banking under "passporting rights" within the EU.

-

Virtual banks must follow strong customer authentication (SCA) rules.

-

Popular providers: N26 (Germany), Revolut (UK), Bunq (Netherlands).

2. United States

-

All providers must comply with KYC (Know Your Customer) and AML rules.

-

Non-residents can open accounts through services like Payoneer or Mercury with proper documentation (e.g., passport, tax ID).

-

FDIC insurance is available through partner banks.

3. Asia

-

Regulations differ significantly:

-

Singapore: Encourages digital banking under the Monetary Authority of Singapore (MAS) with clear licensing.

-

India: Virtual accounts are allowed but often require a link to a physical address and Aadhaar for residents.

-

4. Latin America & Africa

-

Many countries have limited regulatory support for virtual banking, but cross-border services (e.g., Wise, Payoneer) fill the gap.

-

Local fintech ecosystems are growing, especially in Brazil, Nigeria, and Kenya.

Useful Tools and Services

Here are some popular and reliable tools that help global users manage virtual bank accounts abroad:

| Tool / Service | Features | Availability |

|---|---|---|

| Wise (formerly TransferWise) | Multi-currency account with real exchange rates, global bank details | Available in 50+ countries |

| Payoneer | Receive global payments, especially for freelancers and e-commerce | Accepted in 190+ countries |

| Revolut | Personal and business accounts, supports crypto, investments | Mostly EU, US, UK |

| N26 | European virtual bank with IBANs and mobile-first features | EU and US |

| Mercury | US-based virtual bank for startups, remote-friendly onboarding | For US-incorporated businesses |

| Monese | EU/UK-based virtual banking with easy setup for expats | Europe only |

-

Currency calculators: XE.com, OANDA

-

Fee comparison tools: Monito.com

-

International tax guides: Nomad Capitalist, Tax Foundation

-

Virtual address providers: EarthClassMail, VirtualPostMail (for receiving mail in the US or EU)

FAQs about Virtual Bank Accounts Abroad

1. Can I open a virtual bank account abroad without visiting the country?

Yes. Most virtual bank accounts allow remote onboarding using scanned ID documents and video verification. However, some countries may require a local tax ID or virtual address.

2. Are virtual bank accounts safe?

Reputable services use encrypted platforms and follow financial regulations like AML and KYC. Always check if the service is regulated by a financial authority and whether deposits are insured (e.g., FDIC in the US or BaFin in Germany).

3. What documents are needed to open one?

Typically required:

-

Passport or national ID

-

Proof of address (utility bill or digital address provider)

-

Tax identification number (in some cases)

-

Business registration (for company accounts)

4. Are there any limits on transfers or withdrawals?

Yes, depending on the provider. For example, Wise and Payoneer have daily/monthly limits on transfers and ATM withdrawals. Limits may also depend on whether your account is verified or linked to a business.

5. How are virtual bank accounts taxed?

Tax treatment depends on your country of residence. If you're a tax resident in one country but earn through a foreign virtual account, you may still need to declare those earnings. Consult a tax advisor for compliance with FATCA, CRS, or local tax laws.

Final Thoughts

Virtual bank accounts abroad are revolutionizing how global users manage money. They offer flexibility, accessibility, and cost savings—especially useful for freelancers, global businesses, remote workers, and digital nomads. As regulations and tools continue to evolve, it’s crucial to stay informed and choose services that align with your financial goals and compliance requirements.

With the right platform and awareness of legal obligations, you can unlock seamless global banking—without ever stepping into a bank.